2024-08-26T08:01:00

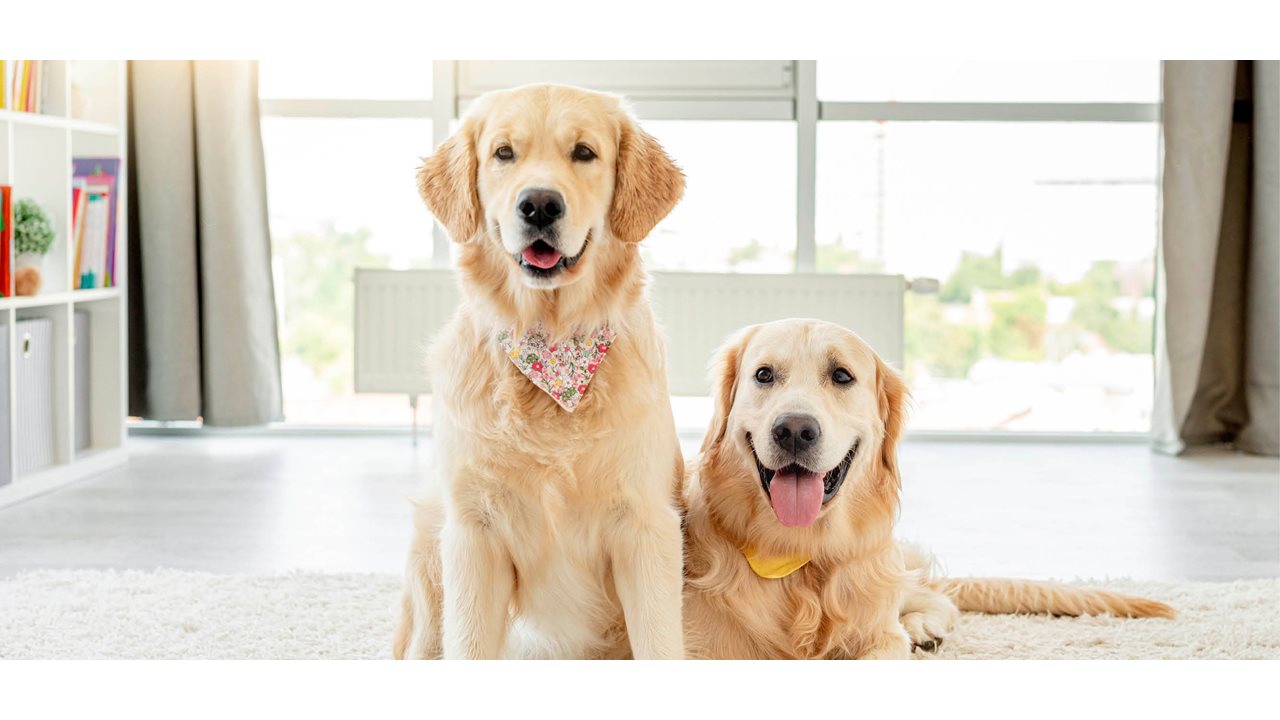

(BPT) – When you find a puddle of pee on your dog’s favorite snooze spot, it’s easy to jump to worry. You might even be asking yourself if she did it to be spiteful. While it’s not uncommon for dogs to urinate inside because of a behavioral problem, it is unlikely she’s misbehaving.1,2 In fact, she could have a medical condition called canine urinary incontinence (UI) due to urethral sphincter hypotonus. Here are some questions you might have, answers to help you narrow down why your dog is having indoor accidents, and what steps you can take next.

1. “What makes this type of incontinence different from other urinary conditions?”

When a female dog has weak urethral sphincter muscles, this can lead to a lack of bladder control that causes her to involuntarily leak urine. If your dog is suffering from this type of canine UI, finding pee puddles inside would feel out-of-the-blue.

2. “Are some dogs more likely to leak?”

Any dog can experience urinary incontinence, but it’s most common in spayed middle-aged female dogs. In fact, up to 20% of spayed female dogs may develop urinary incontinence.3 Midsized and large breeds are also predisposed to it; the most commonly affected are Old English sheepdogs, Doberman pinschers, boxers, German shepherds and Weimeraners.4

3. “How can I be sure this isn’t just my dog acting out?”

While dogs with behavioral issues may pee when greeting a new person or becoming overexcited, a dog experiencing incontinence is usually well-behaved and housetrained. Often dogs suffering from this type of incontinence don’t even realize they voided their urine and are just as confused as you are.

4. “Are there any signs I should look out for?”

Dogs with incontinence drip or leak urine when they sleep, so finding wet spots in their favorite places to relax is a telltale sign. Also, because of the way the urine leaks, you might notice red, irritated skin around the genitals and excessive licking of that area.

5. “This sounds like something I’m dealing with. What should I do?”

The best rule of thumb is if something seems off with your dog, call and schedule an appointment with your veterinarian right away. They will be able to start the process of accurately diagnosing your dog and help you figure out the next steps.

6. “I don’t want my dog to suffer from this. Can incontinence be treated?”

Don’t worry. Your dog’s condition is treatable. If your dog is diagnosed with urinary incontinence due to urethral sphincter hypotonus, your veterinarian may prescribe PROIN ER™ (phenylpropanolamine hydrochloride extended-release tablets). This flavored, once-a-day tablet can help your dog have better weeks without the leaks. For more information, visit proin-er.com.

No matter the reason, your dog unexpectedly peeing inside is cause for concern. If you’re noticing this unusual behavior, consult your veterinarian and ask if PROIN ER™ is right for your dog.

1 Holt PE. Urinary incontinence in the bitch due to sphincter mechanism incompetence: prevalence in referred dogs and retrospective analysis of sixty cases. Journal of Small Animal Practice 1985;26:181–190.

2 Holt PE, Thrusfield MV. Association in bitches between breed, size, neutering and docking, and acquired urinary incontinence due to incompetence of the urethral sphincter mechanism. Vet Rec 1993;133:177–180.

3 Von Goethem B. Schaefers-Okkens A, Kirpensteijn J. Making a rational choice between ovariectomy and ovariohysterectomy in the dog: a discussion of the benefits of either technique. Vet Surg 2006; 35:136-143.

4 Thrusfield MV, Holt PE, Muirhead RH. Acquired urinary incontinence in bitches: its incidence and relationship to neutering practices. J Small Anim Pract. 1998;39:559-566.

IMPORTANT SAFETY INFORMATION: For oral use in dogs only. Not for human use. Keep out of reach of children. If accidentally ingested by humans, contact a physician immediately.

The most commonly reported side effects were vomiting, loss of appetite, diarrhea, excessive salivation, agitation, tiredness, vocalization, confusion, increased water consumption, weight loss, weakness, fever, panting, and reversible changes in skin color (flushing or bright pink). Abnormal gait, seizures or tremors, as well as liver enzyme elevations, kidney failure, blood in urine and urine retention have been reported. In some cases death, including euthanasia has been reported. Sudden death was sometimes preceded by vocalization or collapse.

Instances of dogs chewing through closed vials of PROIN and eating the vial contents have been reported, in some cases resulting in overdose. Keep the product in a secured storage area out of the reach of pets in order to prevent accidental ingestion or overdose, as dogs may willingly consume more than the recommended dosage of PROIN Chewable Tablets or PROIN ER™ tablets. Contact your veterinarian immediately if the dog ingests more tablets than prescribed or if other pets ingest PROIN Chewable Tablets or PROIN ER™ tablets.

PROIN and PROIN ER™ may cause elevated blood pressure and should be used with caution in dogs with pre-existing heart disease, high blood pressure, liver disease, kidney insufficiency, diabetes, glaucoma, and other conditions associated with high blood pressure. Dogs may transition from PROIN Chewable Tablets to PROIN ER™ without a break in administration. However, do not alternate PROIN ER™ with PROIN Chewable Tablets because the effectiveness and safety of interchangeable use have not been evaluated.

The safe use of PROIN and PROIN ER™ in dogs used for breeding purposes, during pregnancy or in lactating bitches, has not been evaluated. Contact your veterinarian if you notice restlessness or irritability, loss of appetite, the incontinence persists or worsens, or any other unusual signs. See prescribing information for complete details regarding adverse events, warning and precautions or visit prnpharmacal.com.