2019-06-20T08:01:00

(BPT) – Total student loan debt has surpassed $1.5 trillion, with 4 in 10 students carrying over $30K in outstanding student loans. Getting accepted into college or graduate school is an exciting time for students and parents. As college continues to get more expensive, determining how you’ll fund your education is a big decision. Review these tips to help keep costs down as you navigate this exciting time in a student’s life.

Stay in state

Consider attending school near home. In-state tuition is much less expensive than attending school out of state. Plus, you’ll save on transportation — and even room and board if you live at home. Public universities are also generally more affordable than private universities.

Additionally, you might be able to save on tuition and related costs by taking classes at a local community college before school begins or during summer breaks. Be sure to confirm that the credits will transfer to the college or university of your choice prior to enrolling in these community classes.

Take advantage of financial aid

Some students and parents are able to finance college or graduate school with their savings, while others may qualify for federal student loans, grants, scholarships and work-study programs.

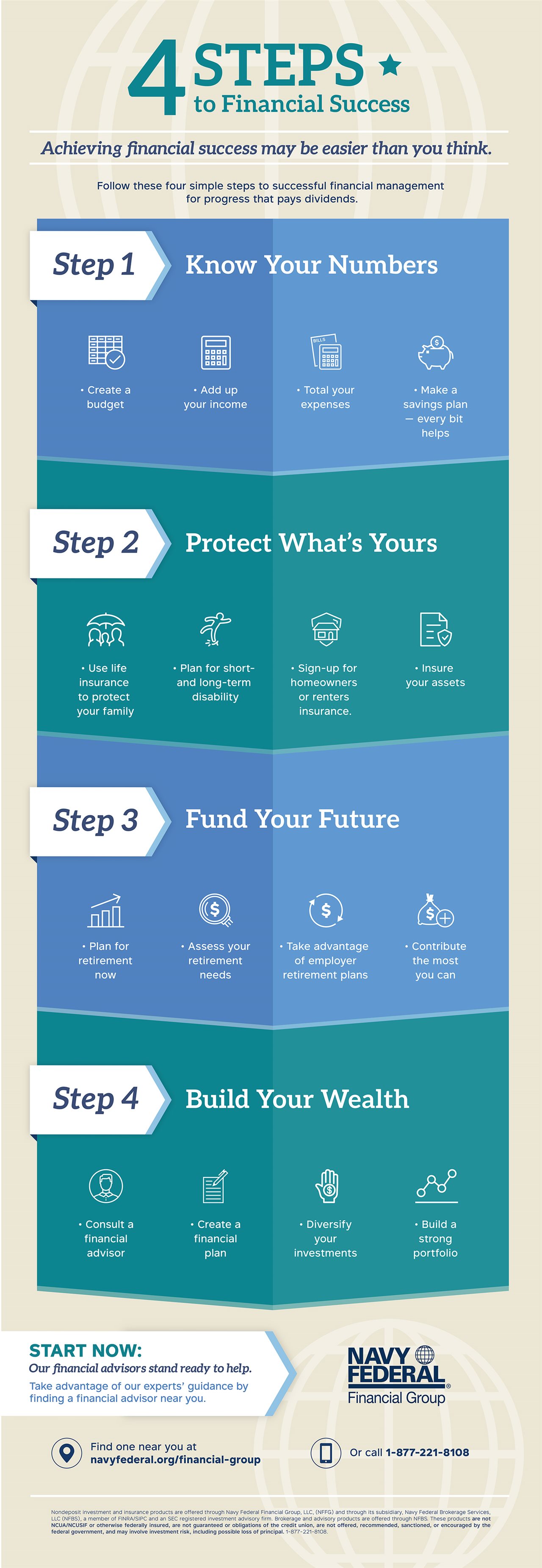

“A student loan is often the first loan product for a young borrower,” said Carrie Foran Sepulveda, manager of education lending at Navy Federal Credit Union. “It can have a significant impact on their post-school financial life, so it’s important to do your due diligence and explore all of your financial aid options.”

If your student aid award or the federal student loan amount granted to you doesn’t cover all your college expenses, private student loans can help fill the gap. For example, at Navy Federal Credit Union, members can apply for student loans with variable rates as low as 5.32% APR or fixed rates as low as 5.99% APR with automatic payments — both for 10-year terms, up to the school-certified cost of attendance.

“We give a 0.25% interest rate reduction by signing up for automatic payments,” added Foran Sepulveda. “This is a great way to establish good financial habits that will help you build your credit history while you’re in school.”

Whether you choose federal or private student loans, make sure you fully grasp the loan’s terms, conditions, and repayment requirements.

Gain college credits in high school

If your high school offers Advanced Placement (AP) programs, you may be able to receive college credits at no cost or test out of some requirements — saving money that would have been spent taking the class during college. Check with the school for their rules on granting AP credits.

Earn money while in school

Apply for on-campus jobs if you have work study granted to you by the school, or look for part-time jobs off-campus to earn extra cash. During school breaks, consider finding a job with full-time hours, but on a short-term basis, to make the most of your time off.

Whether you’re a student or a parent, paying for your education can be doable with these tips in mind.