2024-08-28T12:23:00

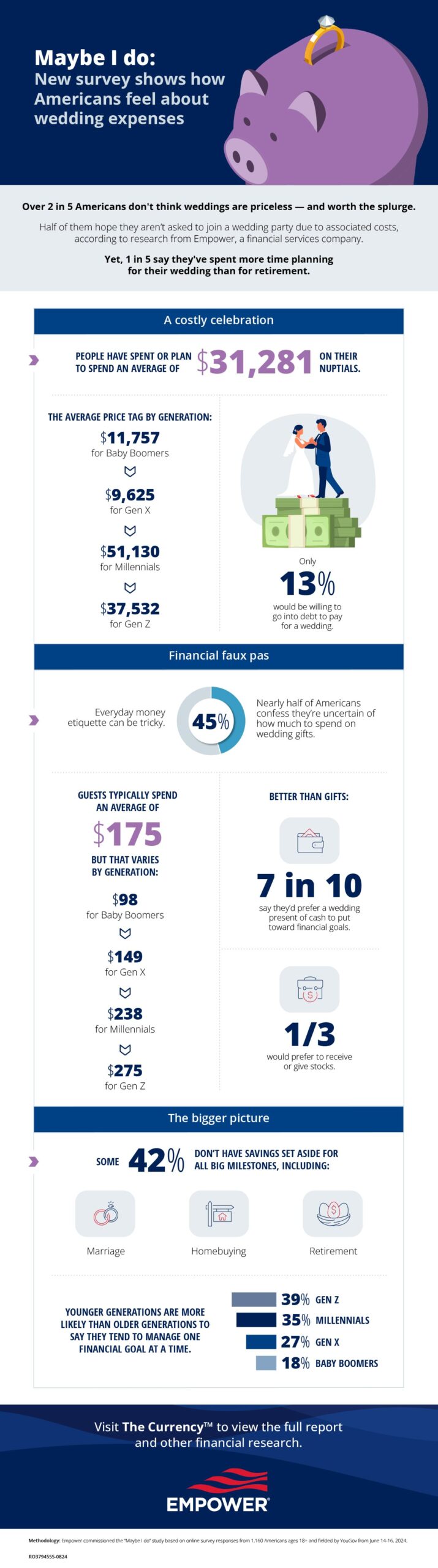

(BPT) – Weddings are exciting, memorable — and expensive. New research from Empower reveals how Americans approach these expenses, and proves generational differences can affect how much we spend.

2024-08-28T12:01:00

(BPT) – Did you know anyone can be diagnosed with type 1 diabetes (T1D), even adults? Although it was long considered a disease that started in childhood or adolescence, nearly half of new T1D diagnoses are among adults. And misconceptions about the disease can result in people being misdiagnosed with type 2 diabetes or experiencing serious complications at diagnosis.

If you have a family history of T1D, or if you would like to take a more proactive approach to understanding your health, you should know that you have options to detect T1D early through screening.

The leading global T1D research and advocacy organization, Breakthrough T1D (formerly JDRF), is encouraging people, especially those with a family history, to “Detect so you can decide” and learn the potential risk for developing T1D. Early detection of T1D can help reduce the risk of life-threatening complications at diagnosis and allow people time to access care, participate in T1D clinical trials, and prepare for future medical needs.

What is T1D?

Nearly 1.45 million Americans live with T1D, which is an autoimmune disease that causes your pancreas to make very little insulin or none at all, and this number is increasing every year. Insulin is a hormone that everyone needs to get energy from the food they eat. People with T1D must take insulin by shots or an insulin pump to survive.

Who is at risk for T1D?

A family history of T1D increases your chance of a T1D diagnosis by 15 times. However, it’s important to know that over 85% of people with T1D do not have any family history of the disease, which is why early detection through screening is so important.

“A type 1 diabetes diagnosis is life-changing and can be overwhelming, but early detection helps individuals and their families prepare and plan,” said Anastasia Albanese-O’Neill, PhD, APRN, AVP of community screening and clinical trial education at Breakthrough T1D. “The benefits of early detection are significant and could lead to a delay in the onset of the disease through approved therapies or accelerate research through clinical trials.”

How early detection works

A simple blood test can detect the presence of certain islet autoantibodies, as the earliest indication of T1D. Screening for T1D typically tests for four autoantibodies, and research shows that most people who test positive for two or more autoantibodies persistently will eventually develop T1D. This early awareness can help people monitor for disease progression and symptoms and help avoid potentially life-threatening complications at diagnosis.

“Screening and monitoring can help reduce the number of people with T1D who experience diabetic ketoacidosis at diagnosis from between 25-50% to 5%,” added Albanese-O’Neill. “Because early detection is so important, we want people to know their options and the steps they can take to screen for T1D.”

How you can take action for your health

In partnership with local clinics nationwide, Breakthrough T1D is expanding early detection opportunities, especially for family members of people who have been diagnosed with T1D. Online resources will help you talk to your doctor about the potential benefits of screening for your family.

In June 2024, new consensus guidance was developed under the leadership of Breakthrough T1D in partnership with over 60 global experts. This new guidance will help the healthcare team care for those who test positive for autoantibodies, monitor for disease progression and guide patients by providing support and information about appropriate therapies, clinical trials and other resources.

To learn more, talk to your health care provider and visit BreakthroughT1D.org/early-detection.

2024-08-28T04:01:01

(BPT) – When disasters like hurricanes, tornadoes or wildfires strike a community and leave residents faced with damaged homes and wrecked cars, even an hour can feel like forever before help arrives. The immediate aftermath of a catastrophe can be chaotic and full of anxiety for those who have lost homes and vehicles.

So one company took action this year to get ahead of the curve, and proactively supported nonprofit recovery response efforts by pre-funding grants before disaster strikes.

This year, State Farm pre-funded the American Red Cross with a $2 million grant to support the nonprofit’s disaster relief efforts. Pre-disaster funding (pre-funding) is a proactive approach that helps give immediate support for disaster relief efforts. The goal of pre-funding is to support nonprofits like the American Red Cross to prepare for and respond to disasters more effectively.

Because of this new approach, communities and families impacted by disasters big and small — including hurricanes, tornadoes, fires and countless other crises — can recover more quickly and reduce the impact of natural disasters.

“Mission Leaders like State Farm are vital to our work, helping drive innovation across our organization, providing capacity to respond immediately in times of crisis,” said Cliff Holtz, president and CEO of the American Red Cross. “I am grateful for their support, which safeguards our ability to care for those in need when the unthinkable happens.”

A history of neighborly support

State Farm has a long history of helping disaster relief programs. However, this is the first year the company has employed a proactive pre-funding approach. In addition to its partnership with the American Red Cross, the nation’s home and auto insurance leader has also pre-funded grants of $250,000 to Convoy of Hope and $250,000 to Midwest Food Bank to help support these community nonprofits to respond immediately following a catastrophe.

“State Farm is committed to helping individuals and families manage the risks of everyday life and recover from the unexpected,” said Apsara Sorensen, State Farm corporate responsibility assistant vice president. “We extend this commitment to the neighborhoods we serve by providing resources and collaborating with nonprofit organizations with a history of disaster response, providing immediate relief and vital necessities during times of need.”

The dangers of severe weather seasons

Throughout the year, homeowners are encouraged to be prepared for severe weather like spring storms, hail, wildfire, tornado and hurricane season. And residents in hurricane prone communities currently are in the busiest, deadliest and costliest months for hurricanes in the U.S., with September being the peak. Even one hurricane occurrence can be devastating. Hurricane Idalia — the only major hurricane to impact the U.S. last year — hit in late August 2023 and resulted in about 8,000 State Farm homeowner and auto claims. State Farm paid approximately $76 million to those customers impacted by Idalia, helping them recover and rebuild their lives in the wake of the event.

How to prep for severe weather and storms

You can’t prevent a hurricane or other natural disasters. However, if you live in areas prone to severe weather and storms, you can prepare yourself and your home ahead of time. Follow these top three proactive insurance tips to ensure you can quickly and easily respond to a natural disaster.

1. Review your insurance coverage. Don’t wait until after disaster strikes to realize that inflation and increasing economic pressures may have impacted the cost of rebuilding. Make sure you have the right amount and type of insurance for your property and to help protect your loved ones.

2. Protect important insurance documents. Keep your important insurance documents and policy paperwork in a protected, waterproof place. You can also install your insurance app for immediate electronic access to insurance documents.

3. Create a home inventory. Make a list of your possessions and their estimated value. You can use technology to help create and safely store your digital home inventory.

Using these three tips can help you place your claims when the worst occurs so your insurer can react quickly and get you the help you need. Find more hurricane prep information with State Farm Simple Insights.

To learn more about State Farm’s efforts to help communities, visit statefarm.com.

This content is sponsored by State Farm.

2024-08-27T09:31:00

(BPT) – Railing is a necessary part of any deck: not just for safety, but also to make an immediate style statement. Here are eight on-trend railing styles sure to enhance any outdoor space:

1. Cable Railing

A modern and popular option among today’s homeowners, cable railing is appreciated for its durability and minimalism. The Trex Signature® X-Series™ features a view-optimizing cable offering that is also easy to maintain.

2. Composite Railing

Much like composite decking, composite railing is an excellent choice for homeowners looking to maximize curb appeal with minimal upkeep. It won’t warp, rot, peel or splinter and never needs to be sanded, stained or sealed.

3. Rod Railing

Sleek, sturdy and undeniably modern, rod rail is a more robust alternative to cable railing and an ideal choice for trendy deck owners looking to add a touch of modern farmhouse flair.

4. Cocktail Railing

Popular with entertainers, cocktail railing (also known as “drink rail”) features a flat top rail, perfect for resting things like a morning cup of coffee, a plate of appetizers or potted plants for a pop of color!

5. Mesh Infill

Featuring a subtle grid-like design, mesh panels offer a happy medium between vertical and horizontal infill and are great for enhancing views. Corrosion-resistant material ensures that this Trex Signature railing will provide excellent views for years to come without compromising on style.

6. Glass Infill

Always in style, glass railing is beloved for being a chic and sophisticated choice that delivers virtually unobstructed, picture-perfect views.

7. Mixed Materials

Can’t decide between all the possible railing materials? Go ahead and mix things up! This combination of metal and composite creates a stylish frame for any outdoor oasis.

8. Rail Lighting

Looking for some extra oomph? Rail lights are a great add-on to any deck railing, whether you’re looking to enhance safety or simply add some atmospheric “ahhh”mbiance.

More deck railing ideas and helpful tools can be found on Trex.com.

2024-08-27T13:09:00

(BPT) – Imagine having the opportunity to move into an opulent mansion. What’s the catch? You don’t have any furnishings, appliances or other modern comforts. No washing machine, refrigerator, couch or bed. Would you still live there?

While four walls and a roof create a shelter from the elements, feeling “at home” requires more than just a physical structure. This August, watch contestants complete challenges and make alliances with other contestants for items that will help them turn an empty space into a livable abode and the ultimate prize of $100,000 in “Estate of Survival”.

Making a house into a home

In this new competition reality TV show, eight strangers move into a lavish but completely empty mansion — no furniture, appliances or any other modern luxuries like air conditioning that make a house feel like a home. To create a space that is welcoming and comfortable, the residents must complete a variety of daily challenges to acquire home goods, avoid elimination and win the ultimate prize: $100,000.

As you watch the show, not only will you be entertained by the variety of challenges — and interpersonal drama — but you’ll also see a range of sophisticated home goods. Some prizes the “Estate of Survival” residents can win include LG ThinQ™-enabled appliances like:

These appliances aren’t just for show. They’re designed for the next-level convenience of the company’s smart lifestyle vision — the Zero Labor Home. LG, America’s most reliable home appliances brand, has designed these quality appliances with reliability and user convenience at its core. Once installed, contestants can enjoy the ease and time-saving benefits of these ThinQ-enabled appliances.

For example, instead of washing laundry by hand, which could take a whole day, a washer/dryer like the WashCombo™ allows residents to wash and dry a load of laundry in under two hours. Contestants would also do well to win an oven with the Scan-to-Cook feature, which allows users to send the optimal cooking settings for select frozen meals straight to the oven simply by scanning the barcode on the product packaging.

Get ready to get inspired!

Are you ready for a new kind of reality TV? Catch the trailer on YouTube and watch all episodes of “Estate of Survival” on Prime Video and LG Channels in the U.S. To shop the fabulous LG appliances from the show, bundle deals and learn more about these and other products, visit LG.com.

2024-08-27T13:01:00

(BPT) – Technology is an integral part of education today. As kids head back to class, it’s crucial to understand the potential digital safety challenges they may encounter. You can equip yourself with the knowledge to educate your children, regardless of their age or grade level, by providing them with tools they need both in and out of the classroom to become responsible digital citizens.

This guide can help you understand some of the risks your kids may face, along with age-appropriate steps to help keep your family safe.

Navigating potential threats

The potential online safety threats your children face and their ability to use and understand technology changes as they grow and develop. Start by setting age-appropriate limits for device use and take time to educate them about potential hazards of the online world. This foundation will help them make smart, informed decisions as they grow and use technology in different ways.

Early introductions to technology: preschool and elementary school

Children’s interactions with technology start even before they enter grade school. During these crucial years, young children use devices to explore videos, play games, complete schoolwork and communicate with friends and family online.

Some of the potential risks at this age include encountering inappropriate content, clicking on dangerous phishing links that may infect their device with malware and even engaging with people they should not.

Start early by setting a good example of responsible digital use. Have open and candid conversations about technology regularly with your children. Reassure them that if they encounter anything online that upsets or scares them, they can talk to you without fear of getting in trouble.

Understand your school’s tech policies and how your kids are being taught to use their devices responsibly. Consider checking out The Smart Talk, a resource created by the National PTA and Norton to help facilitate and guide discussions about safe technology use with your child. Tools such as Norton Parental Control can also help you safeguard your children from online threats by blocking websites and inappropriate content, setting screen time limits and monitoring their activity, including searches and app use.

Growing up fast: middle school and high school

These years can be challenging. It’s when kids engage in more digital exploration, personal communication with friends and expression through social media. Kids will explore a wider range of websites and apps for personal and academic purposes, making them more vulnerable to various online threats. When they use social media and messaging apps, they may also face risks like cyberbullying, exchanging inappropriate content and scams.

Teens can be an easy target for scammers. Educating them about email, text and social media scams will help them better spot one in the wild. Teens should especially be cautious talking to and accepting messages from people they don’t know to ensure their digital and physical safety.

Be open with your child regarding their social media usage and how they engage online, through apps and texts. At this age, teens should understand that once something is online, it lives there forever. Once they send a message or photo, they lose control of where it ends up. Recognize the signs of cyberbullying and encourage your children to confide in you if they experience harassment online or inappropriate messages, such as sexting. Resources like Norton Family can monitor your family’s online presence, protect their devices, manage your teen’s virtual learning environment and even teach them safe online habits. These resources help create a safer, more informed digital environment for your family.

Independent young adults: college

Leaving the nest is a huge milestone that comes with newfound independence and responsibility. It’s crucial for college students to stay informed about risks they may encounter during this new phase of their life.

Young adults manage their own bank accounts, Social Security numbers and sensitive personal information. Scammers target them sometimes disguised as fellow students to access their personal data, steal their identity or trick them into a scam. Using public Wi-Fi networks in coffee shops, dorms or libraries can also leave college students vulnerable to viruses and malware attacks.

Products like Norton 360 with LifeLock identity protection will protect your college student from viruses, hackers and identity thieves. It also includes a virtual private network or VPN to keep their internet browsing private when connecting to public or insecure networks. They can also download Norton Genie, a free scam detector app that leverages AI to identify and avoid common scams in real time.

As a parent, you’ll never stop worrying — but with knowledge about potential threats plus these tools under their belt, you can help your children become smart consumers of technology and educate them on how to navigate the technology needed to get them through school at every age, explore the world, make social connections and learn the skills they’ll need as responsible adults.

Visit Norton.com to learn more about keeping your family safer from online threats.

2024-08-27T09:31:00

(BPT) – In the stillness of early morning, the light of dawn peeks over the horizon, casting a bright light across the water. For many women, from the boat or river in which they stand, these moments spark introspection and can lead to a journey of self-discovery that allows them to find a more confident and resilient version of themselves. Research done by Take Me Fishing and Ipsos supports this journey, finding that women who fish have higher self-esteem and greater perseverance. Female anglers surveyed as part of the study also said that fishing teaches them patience and helps them develop confidence.

There are countless examples of women finding more than just fish in the water. From those whose culture is deeply ingrained in fishing to women who learned how to fish and walk at the same time to others who returned to fishing in adulthood — they’ve all found the best versions of themselves on the water.

Rooted in Culture and Purpose

Ashley Nichole Lewis, a 142nd-generation angler, views fishing as a meaningful connection to her ancestors and the Quinault people of the Pacific Northwest. From a young age, Lewis found solace and inspiration in the tranquility of the water.

“When I’m out fishing, I get to be with myself and tap into a huge ecosystem of life, it gives me a chance to reset mentally,” said Lewis.

Through fishing and boating, she feels connected not only with the past, but it also allows her to see a strong future for herself. Lewis has completed undergraduate and graduate degrees and is currently pursuing her Ph.D. in Indigenous and Environmental History at the University of California, Davis.

“Being on the water gives me this North Star, this compass to what happens next,” said Lewis. “I never thought I would go to college or graduate school. Not only do I find my best self on the water, but I’m also given further direction to what my best life looks like.”

Finding Movement and Mindfulness

Lindsay Kocka first fell in love with fishing as a young girl at her family’s cabin in Minnesota. Over the years, she’s experimented with many types of fishing, but found herself drawn particularly to fly fishing. Now, as a fly fishing, wellness and yoga educator in Montana, she uses fishing to connect with nature, practice mindfulness and share her passion.

“When I’m fishing, I feel connected and integrated in my body outdoors,” said Kocka. “It’s soothing for the nervous system, relaxing and exciting at the same time. It’s important to me to pass along this feeling to other women so that they can reap the same benefits I’ve found.”

Kocka founded Wade Well, a functional movement, mobility and mindfulness method for fly anglers. Through Wade Well, she empowers new anglers and enables seasoned anglers to continue fishing long term, ideally while maintaining pain-free movement. Nearly half of women who fish say fishing teaches them patience, and Kocka’s method reinforces that, along with sharing the other benefits of fishing and boating like joy and mindfulness.

Fostering Connection and Confidence

Angelica Talan, content creator and influencer, remembers learning how to fish with her uncle when she was 7 years old, only to stop a few years later. Just like Talan, many girls who start fishing drop out before the age of 12 (an 11% higher rate than boys). It wasn’t until her daughter found an old picture of her fishing that she was inspired to get back on the water, this time with her daughter.

“Fishing provides a unique avenue for empowering women and fostering independence,” said Talan. “Fly fishing has helped build my self-confidence so that I can empower my daughter to grow her confidence and sense of achievement.”

Now, Talan is an avid angler, and credits fishing with enriching her life by combining adventure and tranquility, which she needs as a mom. She also turns to nature as an escape from her busy life and to connect with her kids on the water.

“Fly fishing in particular brought me closer with my family because we’re learning something new together,” said Talan. “Fishing is a confidence booster for me as a mom. It’s helped make me a better mom because it’s allowed me to show my kids a new skill set and passion.”

Getting More Women on the Water

The unique journeys of these women share the same core values: confidence, patience and purpose. And while their relationships to fishing and boating are all different, they have a similar craving while on the water: more female camaraderie. They believe that getting more women on the water benefits not only those individuals, but everyone around them.

“The female connections I’ve found through fishing have been a great source of support, knowledge sharing, friendship and mentorship,” said Talan. “Fishing has been the most transformative experience for me, and it’s enriched my life in ways that make an impact on my kids and hopefully their friends and future generations.”

For many women, fishing and boating is more than an activity — it’s a journey of self-discovery. Sometimes, the best way to find yourself is to be on the water, cast a line and wait for a bite. To get started with your fishing and boating journey, visit takemefishing.org.

2024-08-27T08:07:00

(BPT) – Have you ever had to skip a fun event with friends due to a temporary lack of cash? If you find it challenging to get through each pay period without running out of money, you’re not alone. According to a recent CNBC/Survey Monkey survey, 65% of Americans currently live paycheck to paycheck.

To better understand the challenges presented by the outdated two-week pay cycle, Chime, the #1 most-loved banking app in the country, partnered with 72Point to learn more about how this system doesn’t support people’s everyday needs. In the survey,* 3 in 5 Americans (59%) say they experience “pay paralysis” — a wave of anxiety or fear due to low funds between pay cycles.

How does that impact daily life? Almost 3/4 of Americans (72%) have had to miss events for financial reasons, including nights out with friends (39%), weekend getaways (34%), concerts (28%) and even weddings (11%).

The good news is, there are ways you can control your money better, to help you handle unexpected emergencies — or participate in events that are important to you. Financial activist and coach Dasha Kennedy offers her tips and tools to help you with smarter money management.

“Not only are 72% of Americans spending most of their paycheck on paying bills, 69% say that’s the first thing they do when receiving their paychecks,” says Kennedy. “Rising costs are impacting Americans’ finances in more ways than one, so it’s important to prioritize your financial well-being.”

Know your numbers

It’s important to have a clear sense of what’s coming in (your paychecks) — and what’s going out (what you spend every month). Writing down your monthly income and comparing it to necessary bills (rent, utilities, insurance, food, transportation, etc.) and what you like to spend for fun or entertainment will help you understand where your money’s going.

“If you’re having a difficult time figuring out your spending patterns, pull your bank statements or credit card statements, whichever account you use to charge your monthly expenses, and highlight every item that was not an essential expense in one color, and every item that was an essential expense in another color,” says Kennedy. “Then you can start identifying cost-cutting and income-increasing measures. For example, eating at home more often can save a lot over time.”

Make a plan

Setting financial goals can help you stay focused. For example, regularly saving toward an emergency fund can help you weather unexpected expenses, or you can save toward a trip or concert tickets you really want. Just be sure to check how you’re doing monthly so you don’t lose sight of your goals.

“The best way to improve your financial future is to create a plan, then check up on it regularly,” Kennedy says. “Stay on track and you’ll be glad you did!”

Create a bill calendar

Keep a calendar with all your bill due dates on it. If you see too many bills due around the same time — like right before your payday instead of after it — try calling your credit card and/or utility companies to ask if they can adjust your monthly due dates. Some companies will change that date, so it’s definitely worth asking. This can help ease a cash crunch at a certain time each month.

Avoid cash crunches with MyPay™ from Chime

Whether you want to grab those concert tickets while they’re on sale, buy a gift for your friend’s wedding or just make sure to pay a bill on time, MyPay™ allows those with an immediate need for money a simple way to access up to $500 of their pay before payday.

MyPay™ is available directly in the Chime app, so members can conveniently access their pay without having to download any extra apps or sign up for a separate subscription. Chime members become eligible to enroll in MyPay by receiving qualifying MyPay™ direct deposits of $200+ into their Chime checking account, plus other qualifying criteria.**

Eligible members can access $20-$500 each pay period (the amount may increase or decrease over time). They simply select how much they’d like to have advanced, and it’s deposited directly into their Chime checking account within 1-2 days, fee-free. Members can also opt to get funds instantly for a flat fee of $2 per advance. There are no other fees, tipping or subscriptions required. Repayment is automatic: The balance is simply repaid when the next direct deposit arrives.

“Nobody wants to endure an emergency or miss out on important life events or fun activities,” says Kennedy. “Creating a plan, building an emergency fund, and taking advantage of tools that can help you access your own money before payday will all help you enjoy each month with a lot less financial stress.”

Learn more about MyPay™ at chime.com/mypay.

* Survey methodology: This random double-opt-in survey of 2,000 employed Americans split evenly by generation (500 Gen Z, 500 millennials, 500 Gen X and 500 baby boomers) was commissioned by Chime between April 25 and April 29, 2024. It was conducted by market research company Talker Research, whose team members adhere to the American Association for Public Opinion Research (AAPOR) Code of Professional Ethics and Practices. Researchers are also members of the Market Research Society and the European Society for Opinion and Marketing Research (ESOMAR).

** To be eligible for MyPay, you must receive Qualifying MyPay Direct Deposits to your Chime Checking Account as set forth in the MyPay Agreement. A Qualifying MyPay Direct Deposit is a deposit from an employer, payroll provider, gig economy payer, government benefits payer, or other permitted source of income by Automated Clearing House (“ACH”) or Original Credit Transaction (“OCT”). Your MyPay Credit Limit and Available Advance Amount may change at any time. MyPay is a line of credit and available limits are based on estimated income and risk-based criteria. Eligible members may be offered a $20 – $500 Credit Limit per pay period. Your Credit Limit and Available Advance Amount will be displayed to you within the Chime app. MyPay is currently only available to eligible Chime members in certain states. Other restrictions may apply. See MyPay Agreement (The Bancorp Bank, N.A. members) & MyPay Agreement (Stride Bank, N.A. members) for details.

2024-08-27T08:01:00

(BPT) – Taking care of your health is more important as you age, but one aspect of your well-being that’s often neglected is hearing health. For many, hearing loss is ignored until its effects appear: difficulty socializing, isolation or depression, balance problems and even cognitive decline.

Hearing is an integral part of how everyone interacts with the world, physically, mentally and emotionally. And although hearing loss is not reversible, it can be managed with proper intervention.

Here are tips to help you protect your hearing while engaging in activities you love, so you can continue to enjoy them for many years to come, plus advice for checking your hearing status and benefiting from the latest hearing technology.

How loud is too loud?

According to the National Institutes of Health, extended periods of exposure to sounds at or above 85 A-weighted decibels (dBA) can cause hearing loss. For perspective, your lawnmower produces 80-100 dBA, and fireworks 140-160 dBA. Many common activities can impact your hearing over time, leading to hearing loss, tinnitus (ringing in your ears) and balance issues.

For this reason, it’s important to wear hearing protection when engaging in any loud activities, just as you wear sunscreen to protect your skin while outdoors.

Because damage to your ears is cumulative and may not be realized until later in life, the time to protect them is now.

Occupational hazards — at home

While the Occupational Safety and Health Administration (OSHA) has required the use of hearing protection for fields like manufacturing, construction and transportation with exposure to sound at or above 85 dBA since 1981, it’s not something you may think about when working around the house.

However, while doing yardwork or home projects with power tools, lawnmowers and leaf blowers, hearing protection is recommended just as if you were on the job.

The sound of music

If you love attending concerts or play an instrument yourself, too much exposure can be detrimental to your hearing. The National Institutes of Health advises trying inexpensive single-use foam ear plugs to help protect your ears from occasional exposure to loud music and other sounds.

Recreational noise

The same goes for many other activities that can generate loud sounds. If you enjoy motorcycling, snowmobiling, shooting or motor boating, hearing protection is always a good idea. Even typical sporting events can range from 94-110 dBA, making them among the noisiest environments people are regularly exposed to.

How to determine noise levels

If you’re concerned about noise where you frequently spend time, there are some downloadable apps for your smartphone that can gauge the decibel level for you to help you determine if you need hearing protection.

What to do if you notice hearing loss

If you frequently miss parts of conversations or often ask people to repeat themselves, it’s possible hearing loss is the culprit. Other clues: you turn up the TV or radio louder, or you hear intermittent ringing or buzzing in your ears.

The best way to know is by taking a hearing test. Try an easy, convenient online version like the one at LexieHearing.com, developed to identify the possibility of some forms of hearing impairment. It’s always advisable to consult with a hearing health professional if you’re concerned about your hearing.

Good news about today’s hearing aids

Hearing aid technology has come a long way in recent years. In October 2022, the FDA established a new category of over-the-counter (OTC) hearing aids for adults 18 and older with perceived mild-to-moderate hearing loss in order to increase the public’s access to hearing aids and improve overall hearing health. These new hearing aids are available at retail stores nationwide without a prescription.

For example, Lexie Hearing provides its newest Lexie B2 Plus hearing aids direct to persons 18 and older with perceived mild-to-moderate hearing loss, along with free lifetime Lexie Expert support. Their FDA-cleared, rechargeable hearing aids offer clear, quality sound powered by Bose, which provides up to 18 hours of run time on a single charge.

Some OTC options — such as the Lexie B2 Plus Hearing Aid — are also FSA and HSA eligible, and available through some insurance hearing health plans.

The importance of hearing

For anyone with mild-to-moderate hearing loss, being able to hear your friends and loved ones, as well as participating in everything you love, makes all the difference for your physical, mental and emotional well-being. Using hearing aids may help slow the risk of cognitive decline for some, and even improve your interpersonal relationships.

Being able to fully participate in your active life for years to come is well worth the effort of protecting your hearing — and successfully managing the hearing loss you may already experience.

In honor of Healthy Aging Month, learn how to stay fully engaged in your life at LexieHearing.com.

2024-08-27T07:01:00

(BPT) – As soccer players know, you can’t win unless you have a game plan.

According to the U.S. Bureau of Economic Analysis, the personal savings rate in the U.S. hovers below 4%, while household debt and credit card delinquency rates are both rising, especially among Gen Z, as reported by the Federal Reserve Bank of New York.

In the game of life, saving should be just one part of your financial strategy but knowing the benefits of responsibly managing your credit is equally important. Whether you are gearing up to buy a home, get an education or start a business — understanding your FICO® Score is an important first step in laying the foundation for financial literacy.

That’s why this summer, FICO, a leading software analytics company, teamed up with Chelsea Football Club and the U.S. Soccer Foundation to offer free financial education workshops for students and adults in the cities where Chelsea is playing on their summer tour.

Workshop participants were also able to attend their local match for free.

Here is a starter playbook of the 3 ways soccer and financial literacy are similar:

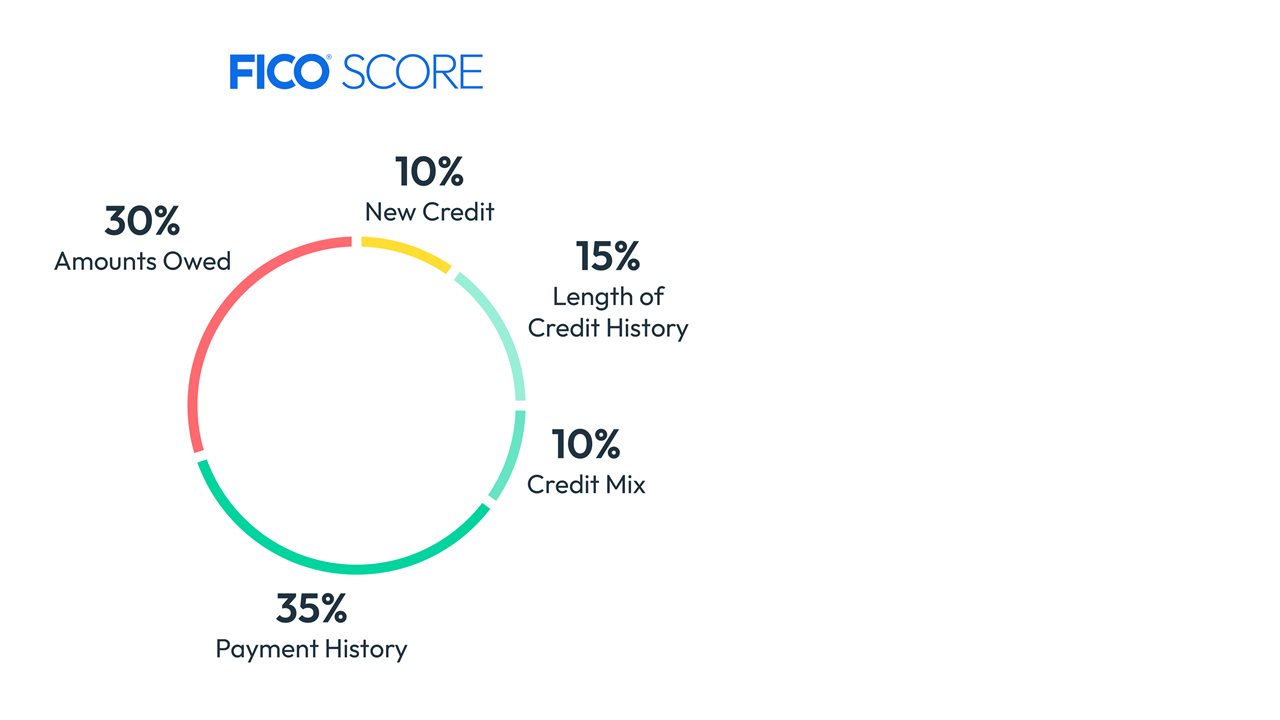

Many factors go into your FICO® Score. It’s calculated based on data that is collected by the three major credit bureaus. This data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). Because your credit report changes based on your financial behaviors, like whether you pay your bills on time, so does your FICO Score. That means it’s important to know how your financial choices can impact your FICO Score.

You can check your FICO® Score for free at https://www.myfico.com/free.

FICO also offers free educational resources on myfico.com relating to budgeting — like a college budget calculator and articles about budgeting systems and budgeting for couples.

To access useful educational resources — and find out how to participate in a live or virtual Score A Better Future™ workshop — visit https://www.fico.com/sabf/.

Whether your goal is purchasing a home, financing a car, or simply starting off your financial journey strong, these educational tips can help you win in the game of life.

FICO and Score A Better Future are trademarks or registered trademarks of Fair Isaac Corporation in the U.S. and other countries.