2025-08-22T12:01:00

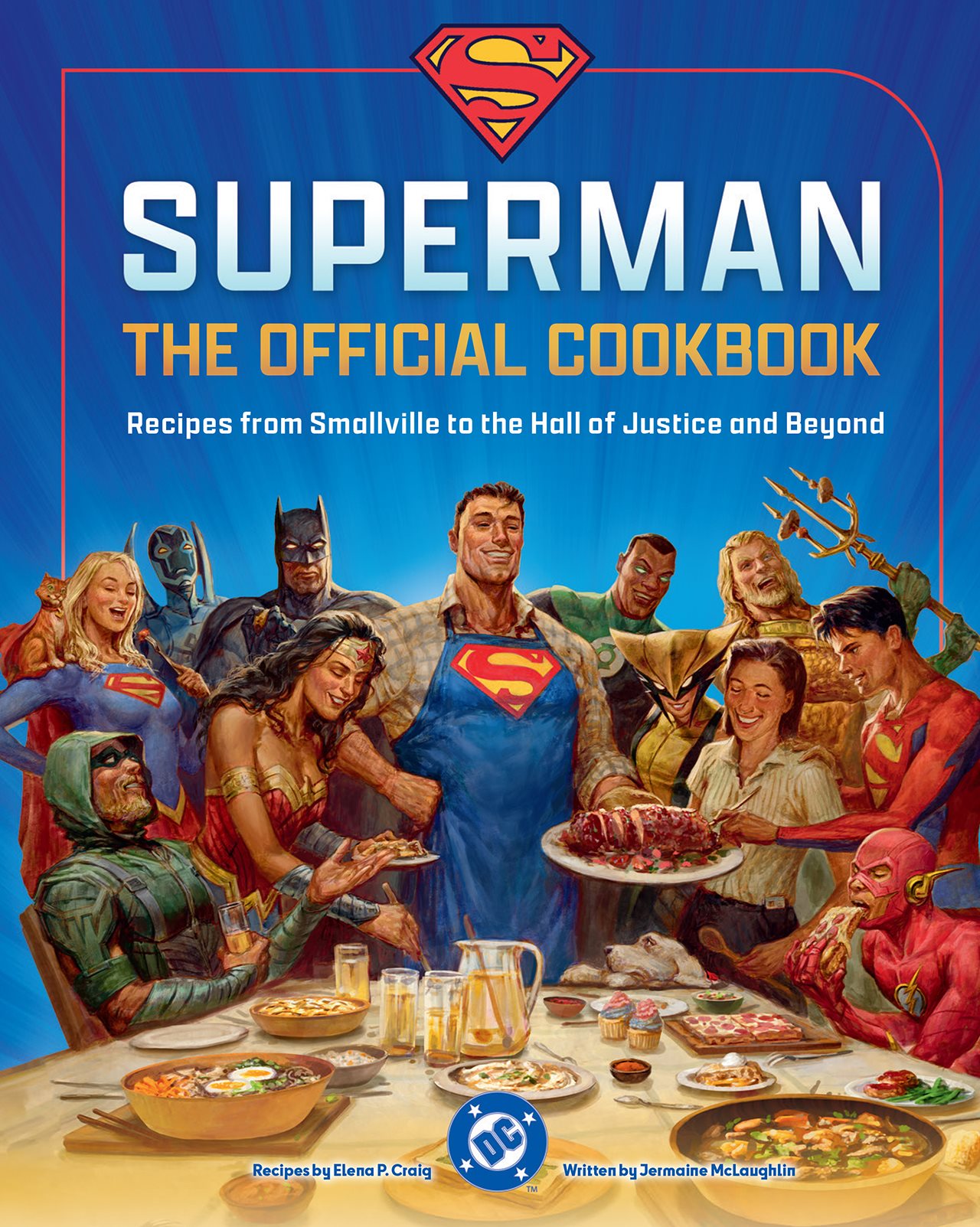

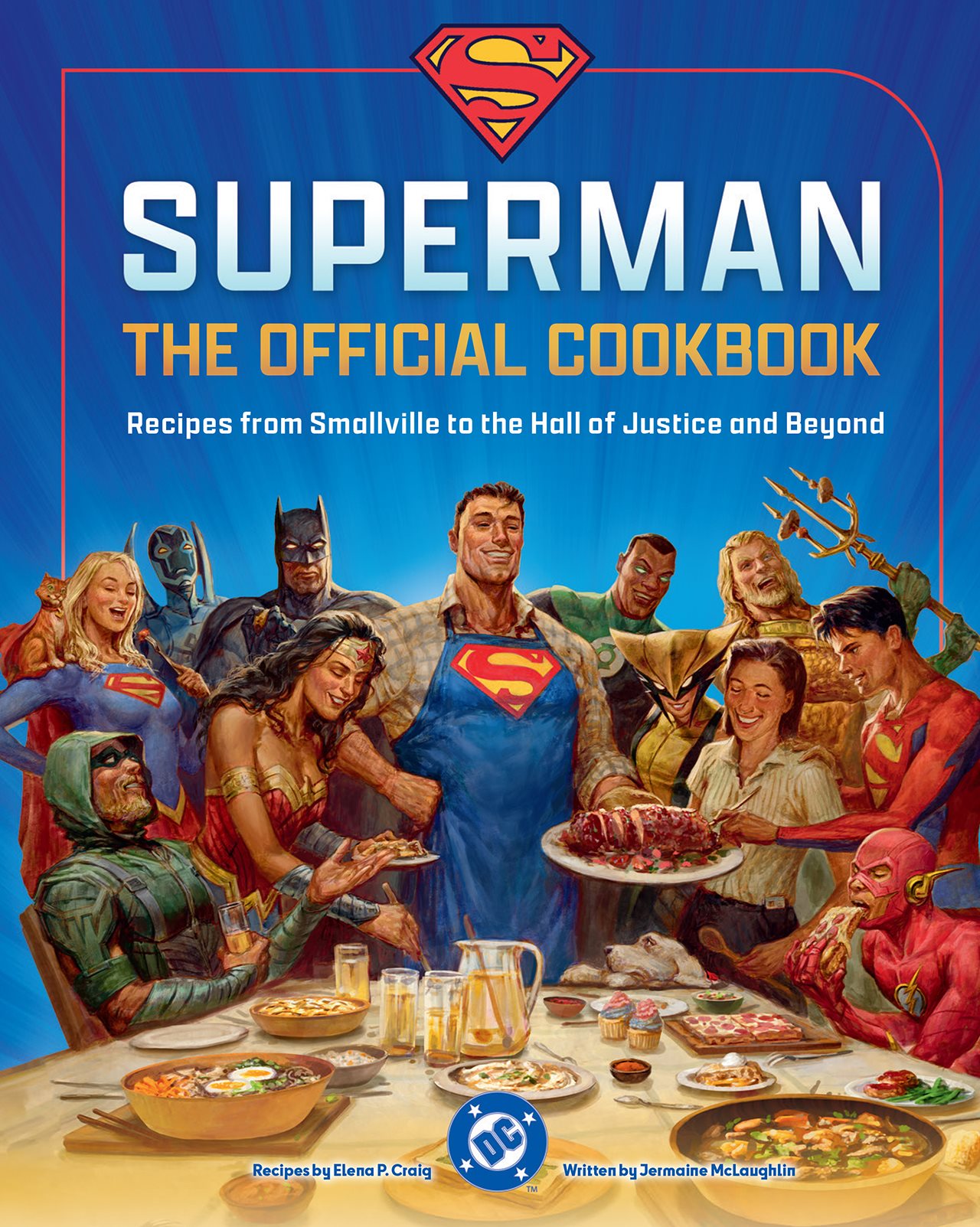

(BPT) – Ever wonder what kind of food Superman grew up on? Wonder no more. Continuing a Kent Family tradition, Martha has put together an heirloom cookbook full of Clark’s favorite dishes, with help from his friends and colleagues. Together, they’ve recreated the beef bourguignon and ketchup from Lois and Clark’s first date, Cyborg’s lucky game day potato skins and J’onn’s Chocos. Martha even recreated Plurb, which she hears is wonderfully awful. She wasn’t quite ready to taste that one herself.

In “Superman: The Official Cookbook: Recipes from Smallville to the Hall of Justice and Beyond” you’ll be fully steeped in DC Comics lore courtesy of the authors, comics writer Jermaine McLaughlin and recipe developer and food stylist Elena Craig.

Each chapter revisits iconic moments in Superman’s life, sorted by various places he’s called home: from Smallville and Metropolis to the Hall of Justice and the Fortress of Solitude. The recipes are appropriate for every skill level, with step-by-step instructions, accessible ingredients and deliciously vivid food photography, making this book ideal for home cooks of all stripes.

From custom cover artwork to gorgeous food photography and fun tidbits about your favorite characters, this cookbook was crafted with fans at its heart.

Want a sneak peek? Here are three recipes to bring out the superhero in every home cook.

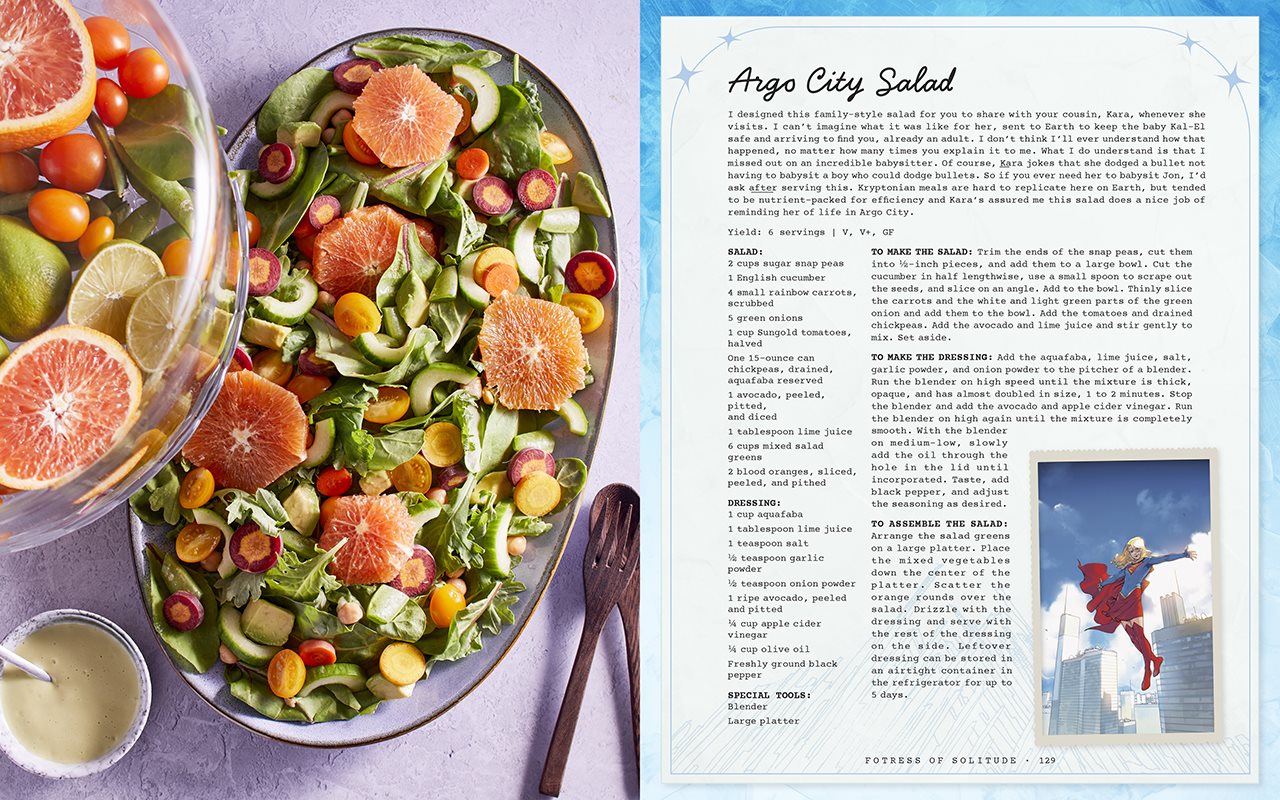

Argo City Salad

Yield: 6 servings

Martha says: “I designed this family-style salad for you to share with your cousin, Kara, whenever she visits. Kryptonian meals are hard to replicate on Earth, but tend to be nutrient-packed for efficiency, and Kara’s assured me this salad does a nice job of reminding her of life in Argo City.”

Salad:

2 cups sugar snap peas

1 English cucumber

4 small rainbow carrots, scrubbed

5 green onions

1 cup Sungold tomatoes, halved

1 15-ounce can chickpeas, drained, aquafaba reserved

1 avocado, peeled, pitted and diced

1 tablespoon lime juice

6 cups mixed salad greens

2 blood oranges, sliced, peeled and pithed

Dressing:

1 cup aquafaba

1 tablespoon lime juice

1 teaspoon salt

1/2 teaspoon garlic powder

1/2 teaspoon onion powder

1 ripe avocado, peeled and pitted

1/4 cup apple cider vinegar

1/4 cup olive oil

Freshly ground black pepper

Special tools:

Blender

Large platter

To make the salad: Trim the ends of the snap peas, cut them into 1/2-inch pieces, and add them to a large bowl. Cut the cucumber in half lengthwise, use a small spoon to scrape out the seeds, and slice on an angle. Add to the bowl. Thinly slice the carrots and the white and light green parts of the green onion and add them to the bowl. Add tomatoes and drained chickpeas. Add the avocado and lime juice and stir gently to mix. Set aside.

To make the dressing: Add the aquafaba, lime juice, salt, garlic powder and onion powder to the pitcher of a blender. Run the blender on high speed until the mixture is thick, opaque, and has almost doubled in size, 1-2 minutes. Stop the blender and add the avocado and apple cider vinegar. Run the blender on high again until the mixture is completely smooth. With the blender on medium-low, slowly add oil through the hole in the lid until incorporated. Taste, add black pepper, and adjust seasoning as desired.

To assemble the salad: Arrange the salad greens on a large platter. Place the mixed vegetables down the center of the platter. Scatter the orange rounds over the salad. Drizzle with the dressing and serve with the rest of the dressing on the side. Leftover dressing can be stored in an airtight container in the refrigerator for up to 5 days.

Black and White Tea Sandwiches

Yield: 18 sandwiches

Apparently, this dish helped welcome Damian Wayne into the family. Alfred insists these black and white tea sandwiches helped convince Damian to put down his sword and indulge in some friendly conversation.

Cucumber Sandwiches:

1/2 English cucumber

1/4 teaspoon kosher salt

1 tablespoon finely snipped chives

1/2 cup cream cheese spread

6 slices dark rye or black bread

Chocolate Orange Sandwiches:

1/3 cup chocolate hazelnut spread or favorite chocolate spread, divided

6 slices white bread

2 tablespoons orange marmalade, divided

Special tools:

Box grater

Fine-mesh strainer

1 1/2-by-4-inch bat-shaped cookie cutter

Paring knife

2-inch round cookie cutter

To make the cucumber sandwiches: Peel the cucumber, slice it in half lengthwise, and use a small spoon to scrape out the seeds. Using the largest hole on a box grater, shred cucumber into a medium bowl and then combine it with the salt. Transfer cucumber to a fine-mesh strainer placed over the bowl, weight it down with a bowl or plate, and leave it to drain for 15 minutes. After 15 minutes, give the cucumber a press with your hands to release any remaining liquid, discard the liquid, and add the cucumber back to the bowl. Add the chives and cream cheese to the bowl and mix until thoroughly combined.

Divide the mixture among 3 slices of the bread, then top each with the remaining slices. Use the cookie cutter to cut three bats out of each sandwich. With an intricate shape like the bat, a small paring knife is helpful to complete the cuts. Arrange on a plate loosely covered with paper towel and refrigerate while making the chocolate sandwiches.

To make the chocolate sandwiches: Spread a thin layer of chocolate spread on each piece of bread, about 1 tablespoon for each slice. Spread a thin layer of orange marmalade on half of the bread pieces, about 1 1/2 teaspoons each. Top with the other bread slices and use circle cookie cutter to cut 3 circles from each sandwich.

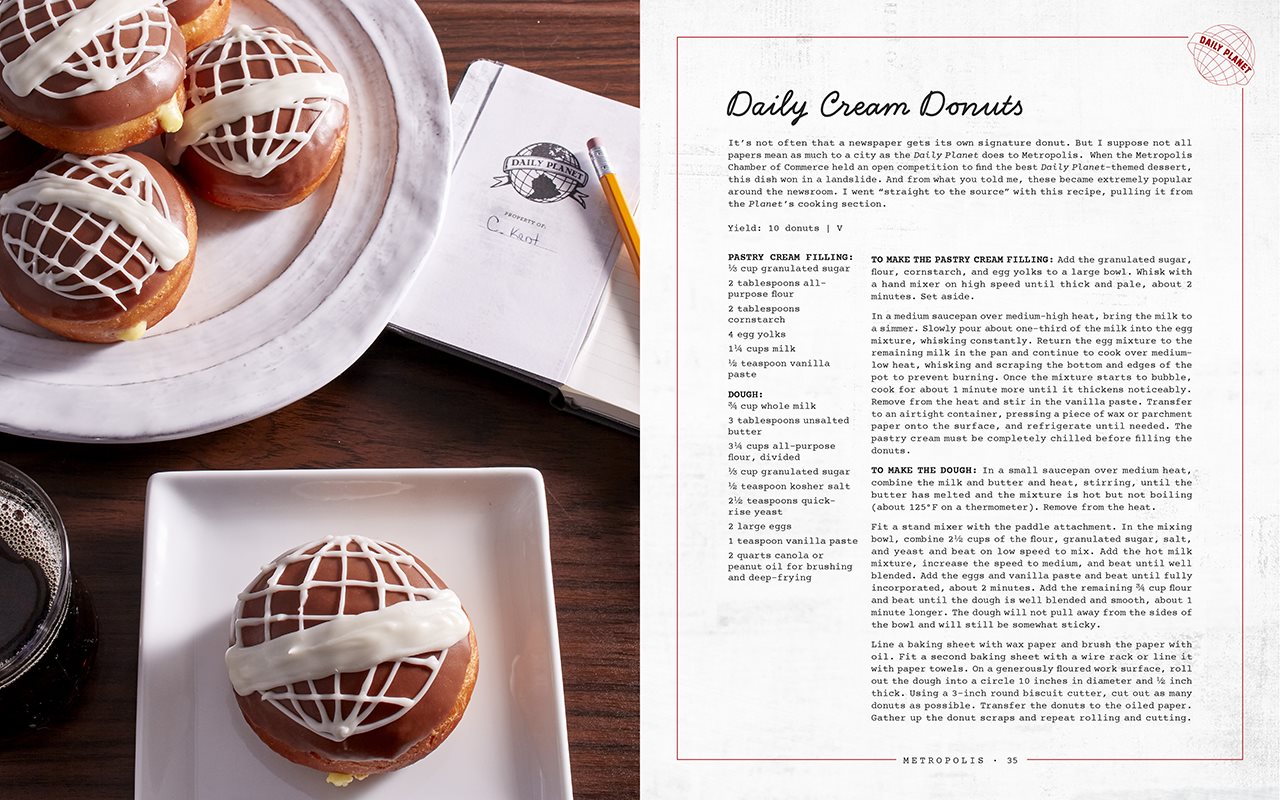

Daily Cream Donuts

Yield: 10 donuts

It’s not often that a newspaper gets its own signature donut. When the Metropolis Chamber of Commerce held an open competition to find the best Daily Planet–themed dessert, this dish won in a landslide.

Pastry cream filling:

1/3 cup granulated sugar

2 tablespoons all-purpose flour

2 tablespoons cornstarch

4 egg yolks

1 1/4 cups milk

1/2 teaspoon vanilla paste

Dough:

3/4 cup whole milk

3 tablespoons unsalted butter

3 1/4 cups all-purpose flour, divided

1/3 cup granulated sugar

1/2 teaspoon kosher salt

2 1/2 teaspoons quick-rise yeast

2 large eggs

1 teaspoon vanilla paste

2 quarts canola or peanut oil for brushing and deep-frying

Chocolate glaze:

3 tablespoons unsalted butter, melted

1 1/4 cups powdered sugar

1/4 cup bittersweet chocolate chips, melted

4-6 tablespoons hot water, plus more as needed

Vanilla glaze:

6 tablespoons unsalted butter, melted

2 1/2 cups powdered sugar

1 teaspoon vanilla extract

5 tablespoons hot water, plus more as needed

Special tools:

Hand mixer

Instant-read thermometer

Stand mixer with paddle attachment

3-inch round biscuit cutter

Deep fryer or Dutch oven

Deep-frying thermometer

Pastry bag fitted with a large writing tip

To make the pastry cream filling: Add the granulated sugar, flour, cornstarch and egg yolks to a large bowl. Whisk with hand mixer on high speed until thick and pale, about 2 minutes. Set aside.

In a medium saucepan over medium-high heat, bring milk to a simmer. Slowly pour about one-third of the milk into the egg mixture, whisking constantly. Return the egg mixture to the remaining milk in the pan and continue cooking over medium-low heat, whisking and scraping the bottom and edges of the pot to prevent burning. Once the mixture starts to bubble, cook about 1 minute more until it thickens noticeably. Remove from heat and stir in the vanilla paste. Transfer to an airtight container, pressing a piece of wax or parchment paper onto the surface and refrigerate until needed. The pastry cream must be completely chilled before filling the donuts.

To make the dough: In a small saucepan over medium heat, combine the milk and butter and heat, stirring, until butter has melted and the mixture is hot but not boiling (about 125F on a thermometer). Remove from the heat.

Fit stand mixer with the paddle attachment. In the mixing bowl, combine 2 1/2 cups of the flour, granulated sugar, salt and yeast and beat on low speed to mix. Add the hot milk mixture, increase speed to medium, and beat until well blended. Add the eggs and vanilla paste and beat until fully incorporated, about 2 minutes. Add the remaining 3/4 cup flour and beat until the dough is well blended and smooth, about 1 minute longer. The dough will not pull away from the sides of the bowl and will still be somewhat sticky.

Line a baking sheet with wax paper and brush the paper with oil. Fit a second baking sheet with a wire rack or line it with paper towels. On a generously floured work surface, roll out the dough into a circle 10 inches in diameter and 1/2 inch thick. Using a 3-inch round biscuit cutter, cut out as many donuts as possible. Transfer the donuts to the oiled paper. Gather up the donut scraps and repeat rolling and cutting. Cover donuts with a clean kitchen towel and let rise until soft and puffy, about 30 minutes.

Pour oil to a depth of 2 inches into a deep fryer or Dutch oven and warm over medium-high heat until it reads between 320 and 325F on a deep-frying thermometer. Carefully lower 1 or 2 donuts into the hot oil and fry until dark golden, about 1 1/2 minutes. Turn donuts over and fry until dark golden on the second side, about 1 minute longer. Transfer to the wire rack baking sheet. Repeat to fry the remaining donuts, allowing the oil to return to between 320 and 325F between batches.

Once the donuts are cool, fill a pastry bag, fitted with large writing tip, with the pastry cream. Use a chopstick to poke a hole in the side of each donut, sticking it in about halfway across. Fill each well with pastry cream until you see the center puff slightly.

To make the chocolate glaze: Combine the butter, powdered sugar and melted chocolate in a medium bowl, whisking until combined. Add hot water until you have a glaze that is still thick but ribbons off the spoon. Glaze each donut by dipping the top into the glaze and letting the excess drip back into the bowl. Set on a baking sheet. When all the donuts have been glazed, let them set up for 10 minutes before moving on to the vanilla glaze.

To make the vanilla glaze: In a small bowl, mix together the butter, powdered sugar and vanilla. Add the hot water until you have a glaze that is still thick but ribbons off the spoon. Place the vanilla glaze into a squeeze bottle with a fine tip or a pastry bag fitted with a small writing tip. Pipe the globe grid onto each donut. Allow to set for 10 minutes before serving.

The donuts are best served day of, but can be stored in an airtight container for up to 2 days.

Time to get cooking! From Jimmy Olsen’s go-to food truck gyro wrap to Oliver Queen’s spicy chili, not to mention Martha’s own award-winning apple pie, these meals combine one-of-a-kind design with comfort-food flavors so you’ll feel at home, wherever you might hang your cape.

Check out all the super recipes in the new “Superman: The Official Cookbook,” now available on Amazon.com.