2018-10-26T07:01:00

(BPT) – To get to the bottom of everyone’s favorite flavors and activities, Cheerios conducted a survey to uncover what consumers were most excited about this fall.

2018-10-26T09:45:00

(BPT) – Foodies with adventurous palates might be tempted to vacation in El Salvador just to enjoy its array of delectable local dishes.

Of course, the green and lushly tropical country called “Land of Jewels” by the locals has much to offer beyond cuisine. Visitors can enjoy volcanoes, beaches, archaeological sites, artisan communities and culturally rich villages along the country’s nine established tourist routes.

Follow these tips for experiencing the destination’s top attractions — and eating like a local along the way.

The capital of San Salvador

Start your trip in the capital exploring a range of stylish restaurants. Fusion-focused cuisine representing Spanish, Mediterranean and American dishes is served at trendy restaurants like Lobby, Oleos and Hacienda Real. The city is also home to historical monuments, theaters, museums and street markets where visitors can order traditional favorites such as pupusas, the national dish. Visitors to San Salvador the second Sunday of November each year can experience the country’s largest National Pupusa Day festival, celebrating with the locals by feasting on the savory corn or rice pancake stuffed with pumpkin, beans, pork crackling, jalapeños, and/or cheese.

Joya de Cerén

A visit to El Salvador’s UNESCO World Heritage archaeological park offers travelers a history lesson on Salvadoran culture and cuisine. In studying the city buried intact under lava circa 600 A.D., archaeologists learned its ancient Mayan residents consumed the same basic foods of today’s Salvadorans. Tried-and-true favorites include the flavorful shellfish stew mariscada; the traditional breakfast “plato tipico” (fried egg, refried beans, corn tortillas, cheese and fried plantains); yucca fritters; empanadas and the sweet-and-salty snacks totopostes (sweet, charred corn tortilla chips).

The Flowers Route

El Salvador’s Flowers Route guides visitors through the Apaneca-llamatepec mountains, showcasing culturally rich artisan towns including Nahuizalco, Salcoatitan, Juayua, Apaneca, Concepcion de Ataco and Ahuachapan. Catch the weekend food festival in Juayua, where vendors from across the country serve up traditional fare such as tamales, soups and filled corn tortillas. Afterward, hike to Los Chorros de la Calera to view waterfalls and take a refreshing swim. Tour coffee plantations in Apaneca and Ahuachapan, stopping for a cup of locally grown java complemented perfectly by native sweets featuring coconut, molasses, toffee, caramel, sweet nance, tamarind or panela. Another must-try? El Salvador’s take on the quesadilla, a rich dessert cake that also pairs well with coffee.

The colonial city of Suchitoto

The nation’s cultural capital boasts well-preserved colonial architecture and cobblestone roads dating to the 15th century. Gourmands can dine at the many restaurants or cafes, sample local cuisine at weekend food festivals, and learn to prepare their own pupusas during interactive workshops at area pupuserías. Visit Santa Lucía church, learn ancient indigo dying techniques through workshops at Arte Añil, or hike to nearby waterfalls, caves and Lake Suchitlán while observing the area’s 200 bird species.

La Libertad Coast

This internationally known surfing destination is also a favorite among seafood connoisseurs who feast on fresh fish, shrimp, octopus and ceviche at top eateries such as Beto’s Restaurante and Café Sunzal. Visit La Libertad Pier for an up-close view of how the local fishing industry thrives. Another not-to-be-missed dining experience is at Acantilados, the newest luxury hotel to open along the country’s Pacific coastline. On-site restaurant FAUSTO puts seafood center stage and is popular for its sushi and tropical beverages.

For more information on El Salvador’s attractions, including its many culinary offerings, visit www.elsalvador.travel.

2018-10-26T07:01:00

(BPT) – There are several myths and misconceptions that exist when it comes to insurance. For example, true or false? It costs more to insure red cars.

The answer is false. Car color has no impact on insurance premiums; however, factors like your driving history, annual mileage driven, the cost of your vehicle and other things will affect how much you’ll pay for insurance.

Insurance is one of the most useful investments you can make to help safeguard your belongings and financial assets, but it’s important to know what you’re purchasing. Here are four things you should know about auto, homeowners or renters insurance policies to ensure adequate protection in the event of an unforeseen or unexpected loss.

1. Myth: Auto insurance covers all vehicle-related issues

Most states require drivers to carry auto liability insurance. This coverage provides financial protection if you’re found to be legally responsible for causing injury to another person or their property. It doesn’t cover damage to your vehicle, however, or items stolen from your vehicle, or damage from a storm or vandalism.

Collision insurance covers you while your vehicle is in motion and you crash into another vehicle or with a fixed object, like a pothole, guardrail or light post. This coverage is typically required by a lender when you finance a vehicle.

Comprehensive insurance is coverage that protects your vehicle when it is damaged while not in motion. Examples of this could include vandalism, theft or an act of Mother Nature like a hailstorm or fire.

“When financing a vehicle, the lender may require you to carry this coverage until it is paid off. If your vehicle is older, however, and it has been completely paid off then comprehensive insurance may not be the right coverage because a vehicle’s value decreases with age. Consider whether the savings of not having comprehensive insurance are enough to offset the risk of potentially having a large repair or replacement bill,” says Kevin Quinn, Vice President of Auto Claims at Mercury Insurance.

2. Misconception: Homeowners insurance protects against damage from all natural disasters

Homeowners insurance covers losses or damages to your house and personal belongings in the event of a fire, sudden flooding caused by a broken pipe, theft and even objects falling from the sky like airplane debris. It also provides liability coverage if visitors suffer injuries on your property, and it can extend to events off the premises as well like if personal property is stolen from your vehicle.

“Generally speaking, homeowners insurance is designed to help you rebuild your home and replace personal property if it is damaged or stolen,” says Christopher O’Rourke, Vice President of Property Claims at Mercury Insurance. “However, you may need to purchase a separate flood insurance policy to protect your home from floods, because these events are usually not covered by a homeowners policy.”

Homeowners should contact the National Flood Insurance Program to inquire about coverage for floods, rising tides or storm surges.

3. Myth: Renters insurance is unnecessary

Renters insurance is very affordable; however, only 41 percent of renters purchase it. And without renters insurance, you’ll have to pay out of pocket if your personal belongings are damaged in a fire or are stolen.

“Unfortunately, your landlord’s insurance policy will not cover any of your personal belongings and it won’t provide liability protection if a lawsuit is brought against you because a visitor slips, falls and injures themselves inside your rental unit,” says O’Rourke. “Renters may not be responsible for repairing the home they live in, but there’s always a chance their possessions and valuables will need to be replaced if they are damaged or stolen, so purchasing a renters insurance policy is a smart way to provide financial security.”

4. Misconception: Your auto insurance policy provides coverage whenever you are driving your vehicle

A personal auto insurance policy protects drivers in case they’re involved in a collision. However, there are certain situations where more coverage is needed.

“With the advent of the gig-economy, many people are turning to ride-hailing jobs, where they can be their own boss and set their own hours,” says Quinn. “Without the proper insurance, however, they’re putting themselves and others at risk if they get into a collision, because your personal auto policy doesn’t cover you when you use your vehicle for commercial purposes. This includes driving for Uber or Lyft, or even pizza delivery.

“Mercury provides ride-hailing insurance, but if it isn’t currently available in your area or you’re using your vehicle to make money in another capacity like delivering pizzas, you’ll want to purchase a commercial auto policy.”

Insurance is a sound investment, but can be complicated, so it’s always a good idea to speak to an insurance agent. These highly trained professionals can provide expert advice and guidance to help ensure you are adequately protected.

2018-10-25T13:01:01

(BPT) – Candyce Norris clearly remembers her wakeup call. In 1996 she was diagnosed with chronic obstructive pulmonary disease, or COPD, a common respiratory disease that makes breathing difficult.

Yet despite her diagnosis, she downplayed her symptoms and how COPD was affecting her everyday life to her doctors for years. “I felt nervous and ashamed to share details about my condition. I didn’t want to be judged because I had smoked for so long,” she said.

“The wakeup call,” Norris said, “was when I realized that no one was judging me. My caregiver and support system, my doctor, everyone wanted to help me manage my symptoms so that I could feel better.”

Norris’ reluctance to share information isn’t unusual for people with COPD. About 27 million people in the U.S. have the condition. Nearly half wait months or years before receiving a proper diagnosis, because many don’t realize the severity of their symptoms — being out of breath, wheezing, chest infections — and attribute them to aging or being out of shape.

In fact, a quarter of patients who experienced common COPD symptoms say they did not mention these symptoms to their healthcare provider. Even after diagnosis, many still downplay their symptoms. In a recent survey, as many as nine out of 10 patients with COPD admitted they are generally not honest with their doctor about their condition.

Dr. David Mannino, pulmonologist and respiratory medical expert at GSK says by the time most people with COPD get a diagnosis, they already have moderate to severe symptoms, and have lost significant lung function. “Without the full picture, a doctor may have trouble helping patients and recommending the right treatment plan. It may also lead to improper care.”

Mannino says being open with your doctor and caregiver is a key to successfully managing COPD. Studies show getting positive social support is linked to benefits like reduced hospitalizations, fewer exacerbations and better habits like engaging in physical exercise.

To encourage the best possible management of COPD, Dr. Mannino says, “patients should put aside any feelings of shame or hopelessness and share their everyday struggles with their doctors and caregivers.”

What is COPD?

COPD is a chronic lung disease brought on by occupational dust or chemicals, smoking or secondhand smoke, and exposure to air pollution. In some cases, people develop COPD due to genetic factors passed down through families. COPD includes two lung problems:

* Chronic bronchitis — coughing and mucus production due to inflammation of the airways over a period of several years

* Emphysema — damage to air sacs in the lungs or collapse of the minuscule breathing pathways in the lungs

For a full list of symptoms and to learn more about COPD, visit www.copd.com.

2018-10-25T12:01:00

(BPT) – On a tree-lined street in the Brookhaven neighborhood of Atlanta, a house built with the goal of better living through design opens its doors to the public this fall. Each space was created with comfort, peace and serenity in mind, from the decluttered entryway, to the intuitive kitchen with luxurious state-of-the-art appliances designed to easily bring healthy choices to a family’s nightly dinner and provide flexibility in food preparation, to the laundry room with (seemingly) space-age appliances that make the chore a breeze, to the fitness room that puts wellness at the heart of a family’s life.

It’s the House Beautiful Whole Home Project Concept House, a first-ever custom-built house that showcases the idea that you can to decorate your way to tranquility.

“House Beautiful’s Whole Home Project shows how your house can enhance the whole you: your energy, your peace, your happiness,” said Carisha Swanson, senior market editor, House Beautiful and Hearst Design Group. “This is the first-ever custom-built house that showcases ideas and innovations that feed happiness and drive well-being in every facet of our lives.”

Here’s a peek at impressive appliance stand-outs in the Concept House:

Kitchen: Luxury kitchen appliance brand Signature Kitchen Suite was chosen to showcase ingenious, purposefully designed tools crafted to respect our authentic connection to food. There’s the 36-inch Built-in French Door Refrigerator, with its convertible middle drawer featuring five temperature zones to choose from, offering the easiest of ways to maintain freshness and the integrity of everything you put in it.

But the real heart of the space is the new 48-inch Dual-Fuel Pro-Range. If you’re a home chef, this range will take your breath away; but for a “Technicurean,” or someone who is passionate about cooking and innovation, it just might bring a tear to your eye. Here are the highlights of this award-winning range:

* Built-in sous vide: Once limited to the pros, sous vide is a cooking technique that utilizes precise temperature control to deliver consistent, restaurant-quality results. This is the industry’s first built-in sous vide home range. Home chefs can achieve professional-level results and capture the full, true flavor of foods.

* Power up or simmer down: Two burners can deliver 23K BTU of horsepower for better searing and quick stir-frying. Two burners simmer down to as low as 100 degrees to prepare sauces and sugary confections. All grates are dual-action for added ease.

* Two-zone induction: When the recipe calls for instant temperatures and precision control, two induction zones meet the need.

* True Combi-Steam: The 18-inch oven combines steam and convection cooking for gourmet results.

* Wi-Fi-enabled: Through the touch of a button on the Signature Kitchen Suite app for Android and iOS devices, users can enjoy the benefits of smart functionality like preheating the oven remotely.

Laundry: Make the “Ultimate Laundry Room” that helps tackle all your laundry needs so you can wash every week and refresh every day. Running loads of laundry isn’t everyone’s favorite chore, but these new appliances from LG Electronics give it some high-tech fun, and more importantly, make the process more efficient and effective. Here are a few standouts:

* LG TWINWash System with LG Sidekick: This two-in-one powerhouse cuts up to 30 minutes off your washing time with TurboWash technology. But it’s the LG Sidekick that packs the punch. It’s a secondary mini-washer that sits beneath the main washer and is designed for small loads. Have a basket of whites with one red shirt? No problem. Pop the shirt into the Sidekick and run both loads at once — or run them separately.

* LG Styler: A first-of-its-kind steam clothing care system and the only certified as asthma and allergy friendly by Asthma and Allergy Foundation of America, LG Styler reduces wrinkles and odor, sanitizes and refreshes garments with the fastest cycle on the market today — as little as 20 minutes. It’s a slim closet-like unit that uses pure steam (no chemicals!) to refresh, de-wrinkle and deodorize your clothes between cleanings. It also works with other items like bedding and sportswear. So, that raggedy old stuffed animal your toddler won’t put down … ever? Pop that into the Styler and it’ll be fresh, clean and sanitized.

Are they enabled with Wi-Fi? Oui-oui! Together, along with the companion dryer, they create the ultimate laundry room.

After the public showing, the Whole Home Project Concept House will be put up for sale. You can read all about it in House Beautiful‘s November 2018 issue.

2018-10-25T12:31:00

(BPT) – From family feasts to office parties, the holidays bring an abundance of leftovers. Think mountains of turkey, buckets of gravy and stacks of side dishes.

“This season, give yourself and your family the gift of enjoying holiday leftovers with food safety top of mind,” says Shelley Feist, executive director of Partnership for Food Safety Education. “Nobody wants to get sick during the holiday season, but unfortunately foodborne illness does affect about 1 in 6 each year. A few simple tips can help you avoid wasting leftovers and help you keep your family safe.”

Make another safe and delicious meal with holiday leftovers. The nonprofit Partnership for Food Safety Education offers these smart and safe tips for storing, reheating and enjoying your holiday leftovers:

This holiday season, the Partnership for Food Safety Education has teamed up with food industry leaders including Ardent Mills, Cargill, Costco Wholesale, and the Frozen Food Foundation on the Story of Your Dinner food safety education campaign. For more information, including food safety tips, recipes, videos and kids’ activities, visit StoryOfYourDinner.org.

2018-10-24T12:01:00

(BPT) – Women are a force to be reckoned with in the economy. They own 10 million businesses in the U.S., control an impressive $11.2 trillion in investable assets and are increasingly the primary breadwinner and financial decisionmaker in households.

But this clout is not carrying over when it comes to retirement planning. According to the Prudential’s 2018 Financial Wellness Census, women lag behind their male peers by an average of 43 percent in retirement savings. What makes this trend even more worrying is the fact that by age 85, women outnumber men by two to one.

When comparing balance sheets, men have an average of $203,000 saved up compared to the $115,000 saved by women, according to the census findings. Only 38 percent of women are certain how much monthly income they’ll want to have in retirement.

A new mindset for retirement planning

Given these unsettling statistics, it’s clear there’s much to be done to help women enter retirement secure in the knowledge they can afford the retirement lifestyle they desire. For example, for women, financial security after the death of a spouse was a top concern cited in the census. On the other hand, for men, this consideration did not appear in the top three.

Traditional approaches to retirement planning look at only one facet — retirement savings. But you don’t look at the value of your current job by thinking about the total amount of money you’ll bring in over a 15- or 20-year career.

So why would you approach retirement this way? Instead, just like you think about your household budget today, it’s more useful to reframe retirement planning to think about the monthly or yearly income you’ll need to live the lifestyle you want.

Kent Sluyter, president of Prudential Annuities, says the retirement planning discussion has traditionally focused on accumulating assets for retirement, rather than how consumers can turn savings into a steady income stream that can sustain their lifestyle in retirement.

“People who have worked hard to save for retirement need to be educated about not just financial planning but also retirement income planning and how to protect a portion of their retirement income so they can live the life they earned,” said Sluyter.

With the right guidance, women can develop an income strategy to help them prepare to live in retirement. Still, 66 percent of women don’t work with a financial adviser, either because they say they can’t afford it (42 percent) or they don’t have enough financial assets (26 percent), according to the census.

When it comes to ownership of the various financial products available to help people invest in their future income needs, women again lag behind. To cite a few examples, 29 percent of women own individual retirement accounts, versus 34 percent of men. One in five women (19 percent) own mutual funds compared to one quarter of men.

One financial product that can provide a guaranteed income in retirement is annuities, yet only 7 percent of women have chosen this route.

This lack of adoption around annuities suggests that women have not been made aware of how these guaranteed income products can alleviate many of their concerns around outliving retirement savings and having a consistent income stream throughout retirement.

“Annuities can be a powerful tool to help women create a steady stream of retirement income to supplement other savings,” said Melissa Kivett, Senior Vice President, Chief Marketing and Customer Experience Officer for Prudential Individual Solutions Group. “For anyone, getting the right financial advice before buying an annuity or any other financial product is critical. For women especially, who are increasingly bearing more responsibility as primary wage earners, and being the ‘CFOs’ of their household, it is even more important to help close the retirement income gap.”

Two dozen of the leading financial services companies, including Prudential, recently established the Alliance for Lifetime Income to address this issue and with a goal of promoting greater understanding of how annuities can protect and grow retirement savings. According to the forthcoming Alliance Protected Lifetime Income Index Study, only two out of five Americans have some protected retirement lifetime income in the form of a pension or an annuity.

If you’re interested in learning whether annuities would fit in with your retirement strategy, a financial planner can be a helpful resource. To learn more, visit prudential.com.

2018-10-25T09:09:00

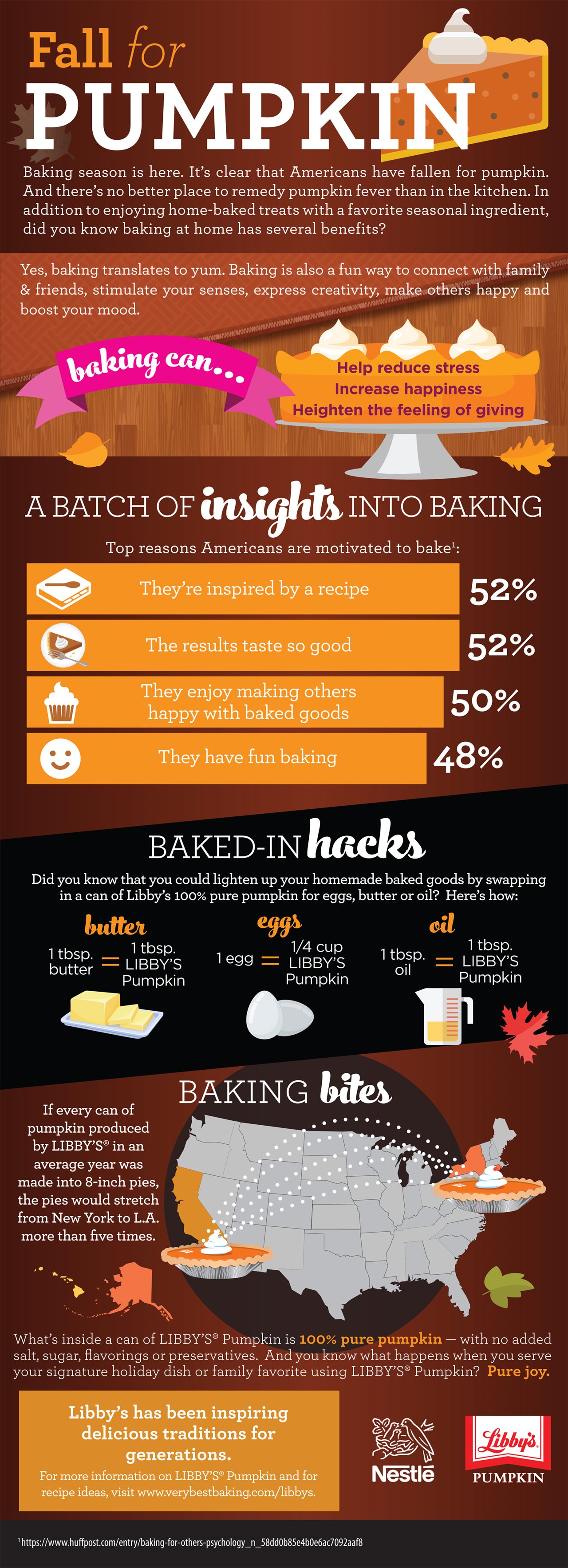

(BPT) – It’s that time of year again! With pumpkin season in full swing, the possibilities on how to get your pumpkin fix seem almost endless, from the iconic pumpkin spice latte, traditional pumpkin pie, pumpkin bars and more. This fall it’s time to spotlight the most anticipated flavor of the season. The following pumpkin snapshot will inspire you in the kitchen to bake up some treats and to make everlasting memories you can feel good about. For more inspiration and ideas, visit verybestbaking.com.

2018-10-24T14:15:00

(BPT) – Navigating the United States’ immigration process is not without its challenges, especially for those who are learning to speak English. From the anxiety of trying to decide whether you qualify for a green card or another visa, to navigating the various information sources and the lingering fear that something was missed, there’s always something to consider.

If any of this sounds familiar to you, you’re not alone, and while you’re doing your best to make sure your immigration materials are handled effectively, you must also watch out for would-be scammers.

Spotting the scams

An immigration scam can take many forms. In some cases you may receive a phone call from an individual who claims to be an immigration official. This person will then notify you that there is a problem with your immigration record — and expect you to pay to solve the issue. In another case a scam artist may arrive at your door purporting to be from Immigration and Customs Enforcement (ICE). They will tell you they are here to serve you a warrant and threaten to deport you. Scams can be found on the web as well. In one case you may receive an email notifying you that you have won a diversity visa lottery and asking you to pay a fee to collect your winnings. In another you may mistakenly try to file your immigration paperwork through a scam website that has been set up to look like a legitimate resource but is in fact a fraud.

While the scam can look very different, the goal is always to play on the fear of losing your immigration status and use that fear to steal your money or personal information. To protect yourself and your family, Western Union offers the following tips to help you spot a scam.

Always question cash

While cash remains a viable payment option for many transactions, you should always be wary of any individual that states you must pay cash. A legitimate government agency will accept other forms of payment as well and you should always remember that the U.S. Citizenship and Immigration Services (USCIS) never accepts cash.

Don’t wait to double-check

Whether you encounter a person on the phone or at your door, you should always verify the things they say. Don’t be afraid to ask for credentials and to double-check them. Contacting the Better Business Bureau (if the scammer was posing as a lawyer or another private service) or the government agency itself can help you verify if the individual who contacted you really is who they say they are.

Never pay for immigration forms

Any scenario that states you must pay for such forms is a scam. The real forms you need can be found for free on the U.S. Citizenship and Immigration Services website.

Keep everything

Sure, it can be difficult sometimes to manage all of the paperwork, but you should make a habit of keeping copies of every single document you have related to your immigration status, especially copies of documents that have been filed or show correspondence with the government. These copies could be invaluable if a question arises later, and having them will give you peace of mind.

Extra fees do not exist

If a proposed fee seems questionable to you, it’s because it probably is. ICE will never offer to look the other way on supposed immigration violations if you pay a hefty fee. Likewise, the U.S. Department of State will not ask you for lottery fees via email.

Always alert authorities

If you feel you’ve been the victim of an immigration scam, or you’re afraid you sent money to a scam via Western Union, call the company’s hotline at 800-448-1492 to report it. Western Union may be able to stop the transaction, if the transfer has not been paid, and refund your money.

Learn more about immigration and other common scams and find ways to protect yourself by visiting the Western Union Consumer Protection Center at www.wu.com/fraudawareness.

2018-10-24T17:25:00

(BPT) – Play is fun for children, but it’s serious business when it comes to their health and development. From peek-a-boo as a toddler to jigsaw puzzles, dolls and toy trains as an older child, play enriches not only their lives at the moment, but their brain development and a whole host of other things, too.

But, what is play, exactly? According to an American Academy of Pediatrics report, “The Power of Play: A Pediatric Role in Enhancing Development in Young Children,” play is an activity that involves active engagement and results in joyful discovery. It is fun and spontaneous, and involves creating an imaginative reality that contains elements of make-believe.

It’s not about passively watching the television or computer screen, and it’s not about the latest and greatest technical bells and whistles on a smartphone. It’s about simplicity, imagination and the unstructured time to create.

“Simplicity has always been at the forefront of classic toy development with the focus on undisturbed, open-ended play,” said Filip Francke, CEO of Ravensburger North America, whose BRIO line has been creating happy childhood memories for more than 130 years. Their new product line, Smart Tech, complements open-ended play and is compatible with other BRIO World products their parents and even grandparents have likely grown up playing with.

Here are just a few benefits of open-ended, unstructured playtime:

* Amplifies creative role play and inspired storytelling.

* Models “cause and effect.”

* Develops critical thinking skills.

* Improves children’s abilities to plan.

* Helps with language and math development.

* Encourages and deepens relationships with siblings, friends and adults, creating the foundation for more healthy relationships in the future.

* Fosters curiosity.

* Encourages problem solving, collaboration and creativity.

* Helps children manage stress.

The AAP is so adamant about the benefits of play that it encourages pediatricians to write out prescriptions for play at well child visits to remind parents, in this increasingly structured world, to give their children plenty of time to play. That’s because more and more, parents are focused on achievement, after-school programs and increased homework demands, even for elementary students.

Inspiring play is as simple as providing the unstructured time and space.

So, whether it’s brightly colored toys for an infant, showing a mirror to an older child to explore her own expressions, reading to children of all ages, giving your child simple toys like blocks, wooden toys, puzzles or a train set — providing your child the opportunity for a daily dose of play is the right prescription for his or her development.